Mortgage rates have remained at or below 3% for nine consecutive weeks. “Many home buyers can benefit from these low rates while home prices are reaching record highs,” Nadia Evangelou, senior economist and director of forecasting at the National Association of REALTORS®, says at the association’s Economists’ Outlook blog.

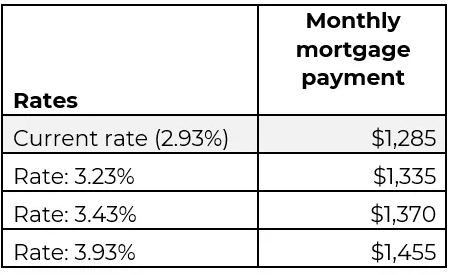

Mortgage rates can make a big difference to what home buyers can afford. The following chart from NAR shows how much the monthly payment changes when rates rise by just 0.3%, 0.5%, and 1%.

Freddie Mac reports the following national averages with mortgage rates for the week ending June 17:

- 30-year fixed-rate mortgages: averaged 2.93%, with an average 0.7 point, falling from last week’s 2.96% average. Last year at this time, 30-year rates averaged 3.13%.

- 15-year fixed-rate mortgages: averaged 2.24%, with an average 0.6 point, rising slightly from a 2.23% average last week. A year ago, 15-year rates averaged 2.58%.

- 5-year hybrid adjustable-rate mortgages: averaged 2.52%, with an average 0.3 point, dropping from last week’s 2.55% average. A year ago, 5-year ARMs averaged 3.09%.

Freddie Mac reports average commitment rates along with average points to better reflect the total upfront cost of obtaining the mortgage.

Source: “Instant Reaction, Mortgage Rates, June 17, 2021,” National Association of REALTORS® Economists’ Outlook blog (June 17, 2021) and Freddie Mac