Single-family rents have climbed at the fastest rate in nearly 15 years. Further, renters are making their preferences known: Rent growth for detached properties is more than three times the rent growth for attached properties, according to CoreLogic’s Single-Family Rent Index.

As inventory remains limited, some Americans are turning to rentals to buy time, but they still desire a single-family home. “While rent growth dipped significantly last April at the start of the pandemic, rising affordability issues and supply shortages in the for-sale housing market and ongoing demographic pressure from aging millennials have continued to place upward pressure on the single-family rental market,” writes Molly Boesel, an economist for CoreLogic. “These factors will persist in the near term, leading to strong rent growth this year.”

Dallas Tanner, CEO of Invitation Homes, a giant in the single-family rental market, recently told CNBC that he views the housing sector as “healthy.” He said his company feels confident about continuing to acquire new properties. “You have this wave of millennials coming our way,” with tens of millions of people looking for housing, Tanner told CNBC. That demand should continue to prop up the rental market, he added.

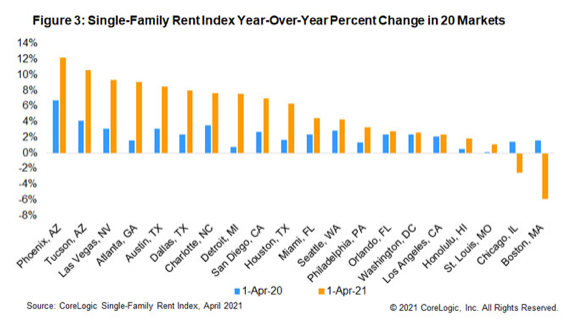

Since the pandemic, more renters have sought out properties in lower-density areas, the CoreLogic report finds. This could include a single-family home, duplex, triplex, quadplex, townhouse, row home, condo, or co-op. The areas seeing the largest uptick in rent growth year over year in April were Phoenix (up 12.2% annually), Tucson, Ariz. (10.6%), and Las Vegas (9.3%).

Source: “Inaccessibility in For-Sale Housing Pushes Up Demand for Single-Family Rentals,” CoreLogic (June 15, 2021) and “Invitation Homes CEO Says He’s Not Worried About a Housing Bubble Despite Price Spikes. Here’s Why,” CNBC (June 18, 2021)