The new year is kicking off with lower mortgage rates for home shoppers and people looking to refinance their mortgages. The benchmark 30-year fixed-rate mortgage dipped to a 4.51 percent average this week, Freddie Mac reports.

“Low mortgage rates combined with decelerating home price growth should get prospective home buyers excited to buy,” says Sam Khater, Freddie Mac’s chief economist. “However, it will be interesting to see how the recent turmoil in the stock market will affect homebuying activity in the coming months.”

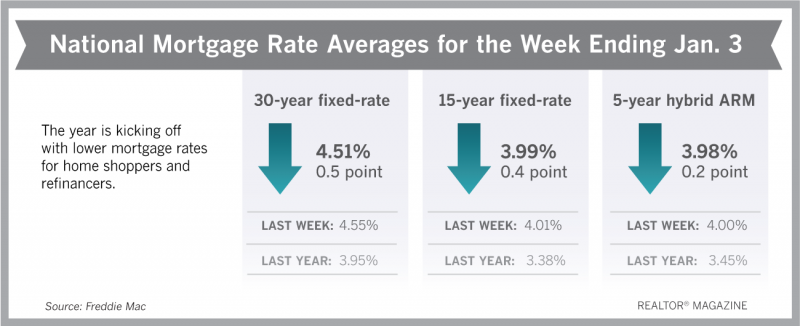

Freddie Mac reports the following national averages with mortgage rates for the week ending Jan. 3:

- 30-year fixed-rate mortgages: averaged 4.51 percent, with an average 0.5 point, falling from last week’s 4.55 percent average. Last year at this time, 30-year rates averaged 3.95 percent.

- 15-year fixed-rate mortgages: averaged 3.99 percent, with an average 0.4 point, dropping from last week’s 4.01 percent average. A year ago, 15-year rates averaged 3.38 percent.

- 5-year hybrid adjustable-rate mortgages: averaged 3.98 percent, with an average 0.2 point, dropping from last week’s 4 percent average. A year ago, 5-year ARMs averaged 3.45 percent.

Source: Freddie Mac